Ever filled a prescription and been shocked by the price-even though your insurance said it was covered? You’re not alone. The reason often lies in something called a formulary tier. These tiers determine how much you pay out of pocket for your meds, and they’re not always easy to understand. But knowing how they work can save you hundreds-or even thousands-of dollars a year.

What Is a Formulary, Anyway?

A formulary is simply a list of prescription drugs your insurance plan covers. It’s not random. Every drug on the list is grouped into a tier based on cost, effectiveness, and how much the insurer can negotiate with drugmakers. Think of it like a menu at a restaurant: some items are cheap, some are pricey, and some aren’t offered at all. The goal? To encourage you to pick lower-cost options when they work just as well.Tier 1: The Low-Cost Go-To

Tier 1 is where you want to be. This tier is mostly made up of preferred generic drugs. These are medications that have been around for years, lost their patent protection, and are now made by multiple companies. Because they’re cheaper to produce, insurers can pass the savings on to you. In most plans, Tier 1 copays are between $0 and $15 for a 30-day supply. For Medicare Part D beneficiaries, the average cost per Tier 1 generic in 2022 was just $1.27. That’s less than a coffee. Common examples include lisinopril for high blood pressure, metformin for diabetes, and atorvastatin for cholesterol. If your doctor prescribes one of these, you’re getting the best deal your plan offers.Tier 2: The Preferred Brand-Name Option

Tier 2 includes brand-name drugs that your insurer has negotiated a good deal on. These aren’t generics, but they’re still considered cost-effective compared to other brand-name options. Maybe the drug has no generic version yet, or maybe it’s slightly more effective for certain patients. Either way, your plan thinks it’s worth covering at a moderate price. Copays here usually range from $20 to $40. That’s still affordable for most people. Drugs like losartan (for blood pressure) or levothyroxine (for thyroid) often land here. Some plans also put non-preferred generics in Tier 2 if they’re slightly more expensive than the preferred ones. The key thing to remember: if your drug is in Tier 2, you’re still getting a good deal-just not the best one.Tier 3: The High-Cost Brand-Name Zone

Tier 3 is where things start to hurt. This tier holds non-preferred brand-name drugs. These are medications that either have cheaper alternatives available, or the insurer didn’t get a strong discount from the manufacturer. They’re still covered, but you’re paying more. Copays here average $50 to $100 per 30-day supply. For some specialty drugs, it can go even higher. Examples include certain antidepressants, pain medications, or newer diabetes drugs like semaglutide (Ozempic) before it was moved to lower tiers. If your doctor prescribes a Tier 3 drug, ask: “Is there a Tier 1 or 2 alternative?” Often, there is-and switching could cut your cost in half.

Tier 4 and 5: Specialty Drugs and the Cost Cliff

Not all plans have five tiers, but many do-especially employer-sponsored plans. Tier 4 and 5 are reserved for specialty drugs. These are high-cost medications used for complex conditions like cancer, rheumatoid arthritis, multiple sclerosis, or rare genetic disorders. Here’s the catch: instead of a flat copay, you usually pay a coinsurance-a percentage of the total drug cost. Tier 4 might be 25% to 33%, and Tier 5 can hit 34% to 50%. A single dose of a Tier 5 drug can cost $10,000 or more. That means your share could be $3,000 to $5,000 per month. No wonder 41% of patients delay or skip these meds because of cost. Some newer Medicare plans now cap insulin at $35 per month, no matter the tier. That’s a rare win. But for most specialty drugs, you’re on your own unless you qualify for financial aid or an exception.Non-Formulary: Not Covered at All

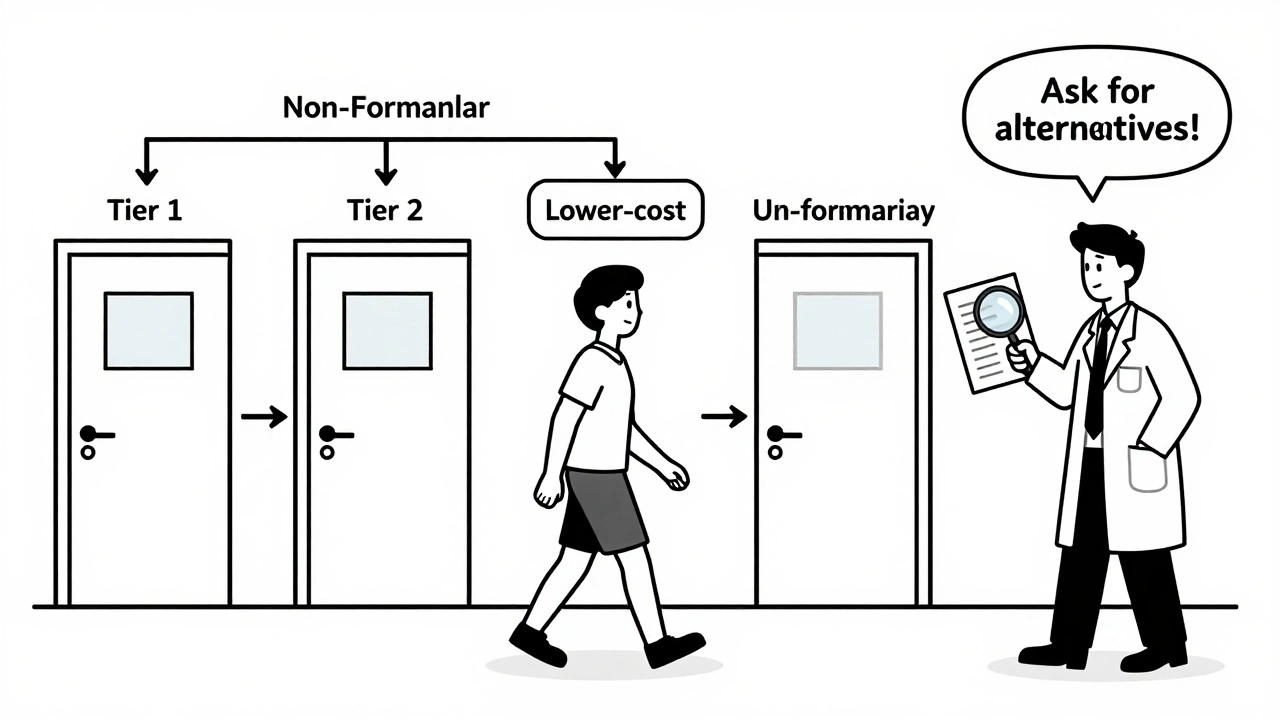

If a drug isn’t on the formulary list at all, it’s non-formulary. That means your insurance won’t pay for it-not even a dime. You’ll pay the full retail price, which can be hundreds or thousands of dollars. Why would a drug be excluded? Maybe it’s new and hasn’t been reviewed yet. Maybe there’s a cheaper alternative. Or maybe the drugmaker didn’t offer a rebate. Sometimes, it’s just bad luck. If your doctor prescribes a non-formulary drug, don’t panic. You can ask for a formulary exception. Your doctor writes a letter explaining why you need it-maybe because other drugs caused side effects or didn’t work. If approved, your plan might cover it at a lower tier.Why Do Tiers Even Exist?

It’s not about punishing patients. It’s about managing costs. Pharmacy Benefit Managers (PBMs)-companies like CVS Caremark and Express Scripts-negotiate rebates with drugmakers. The more they buy, the bigger the discount. They pass some of that savings to you by putting cheaper drugs in lower tiers. The system works: since formularies became common in the 1990s, overall drug spending has been kept in check. Medicare Part D saved billions by steering people toward generics. But there’s a flip side. The more tiers there are, the more confusing it gets. A 2022 study found 61% of patients couldn’t predict their out-of-pocket cost before filling a prescription. That’s not just frustrating-it’s dangerous.

What You Can Do: Take Control

You don’t have to guess. Here’s how to navigate formularies like a pro:- Check your plan’s formulary before you get a prescription. Most insurers have an online tool. Search by drug name or condition.

- Ask your pharmacist: “What tier is this on?” They see the list every day.

- Ask your doctor: “Is there a generic or Tier 1 alternative?” Don’t assume your current med is the only option.

- If you’re hit with a surprise cost, request a formulary exception. Many are approved if your doctor supports it.

- Use tools like Medicare’s Plan Finder or GoodRx to compare costs across plans.

What’s Changing in 2025?

The system is evolving. Starting in 2024, Medicare introduced a new cap on out-of-pocket spending for Part D beneficiaries. By 2025, most people will pay no more than $2,000 a year for drugs-no matter the tier. That’s huge for those on expensive specialty meds. Some insurers are also testing value-based tiering. Instead of just looking at price, they consider how well a drug works. If a Tier 3 drug keeps someone out of the hospital, it might move to Tier 2. It’s a smarter approach-but still early.Bottom Line: Know Your Tier, Save Your Money

Formulary tiers aren’t perfect. They’re complex, sometimes unfair, and often poorly explained. But they’re here to stay. The smart move? Don’t wait until you’re at the pharmacy counter to find out your cost. Do your homework. Ask questions. Push for alternatives. And if you’re stuck with a high-cost drug, fight for an exception. Your wallet-and your health-will thank you.What’s the difference between a copay and coinsurance?

A copay is a fixed amount you pay for a drug-like $15 for a Tier 1 generic. Coinsurance is a percentage of the total cost-you pay 30% of a $10,000 specialty drug, which means you pay $3,000. Copays are easier to budget for. Coinsurance can be unpredictable and expensive.

Can my insurance change my drug’s tier during the year?

Yes. Insurers can update their formularies quarterly. A drug you’ve been taking for years might suddenly move from Tier 2 to Tier 3. Your plan must notify you at least 60 days before the change takes effect. If you’re affected, you can request a temporary exception while you and your doctor find a solution.

Why is my generic drug in Tier 2 instead of Tier 1?

Not all generics are treated the same. Your plan may have a preferred generic (Tier 1) and a non-preferred one (Tier 2). The non-preferred version might be made by a different manufacturer, or your insurer didn’t negotiate a good deal with that company. It’s the same active ingredient, but the price is higher. Ask your pharmacist if a Tier 1 version is available.

Do all insurance plans have the same tiers?

No. Medicare Part D plans mostly use four tiers. Commercial plans vary: 45% use four tiers, 30% use five, and some use just two. Employer plans tend to be more complex. Always check your specific plan’s formulary-it’s not the same as your neighbor’s.

How do I find out what tier my drug is on?

Log into your insurer’s website and look for the “Formulary” or “Drug List” section. You can search by drug name. If you can’t find it, call customer service and ask for the current formulary document. Some plans also send it in the mail. Don’t rely on memory-formularies change often.

What if my drug is non-formulary and I need it?

You can request a formulary exception. Your doctor must submit a letter explaining why other covered drugs won’t work for you-maybe due to side effects, allergies, or past failures. If approved, your plan may cover it at a lower tier. Many exceptions are granted, especially with strong medical justification.

Are there programs to help with high-tier drug costs?

Yes. Many drugmakers offer patient assistance programs that lower or eliminate costs for low-income patients. Nonprofits like the Patient Advocate Foundation also help with appeals and financial aid. Medicare Part D has a Low-Income Subsidy program that reduces premiums and copays. Check your plan’s website or call 1-800-MEDICARE for help.

10 Comments

So let me get this straight-I pay $15 for my blood pressure med, but my friend pays $3,000 for hers because her insurance didn’t ‘negotiate well’? Sounds like a pyramid scheme with more pills.

At least my coffee costs less than my meds. And I don’t even like coffee.

Bro, you’re all missing the real issue-PBMs are middlemen who take 30% of the rebate and call it ‘administrative fee’! In India, we don’t have this tier nonsense. You go to the chemist, he gives you the generic, you pay 200 rupees, done. No forms, no exceptions, no ‘preferred’ BS. Here, you need a PhD just to buy insulin.

And don’t get me started on how these ‘formularies’ are just corporate contracts disguised as healthcare. The real villain? The 12-year-old analyst at CVS Caremark who picks which drugs make the cut based on who gave the best kickback. 😒

Hey everyone, I’ve been on a Tier 3 drug for years-metformin got moved to Tier 2 last year and my bill dropped by 60%. I know it’s confusing, but if you ask your pharmacist, they’ll usually tell you if there’s a cheaper version.

Also, don’t be shy about asking your doctor for alternatives. Most of them know the tiers better than you think. We’re all in this together. 💪

One must question the ontological underpinnings of pharmaceutical tiering: is it not merely a neoliberal algorithmic apparatus designed to externalize bodily suffering onto the individual’s fiscal capacity? The ‘copay’ is not a transaction-it is a moral indictment.

And yet, you suggest ‘asking your doctor’? How quaint. The physician is already a bureaucrat in scrubs, bound by PBM contracts and formulary compliance quotas. Your ‘smart move’ is a delusion wrapped in a pamphlet.

Let’s be clear: if your insurance doesn’t cover your medication, you’re not ‘stuck’-you’re just bad at choosing your plan. You signed up for this. You didn’t read the fine print. You didn’t compare options. Now you’re mad because your body is expensive?

Stop playing victim. Get informed. Or stop taking meds. Either way, don’t whine on Reddit about it.

Why are we even talking about this? It’s all a scam. Tier 1? Tier 5? Who cares. Just give me the drug and shut up.

I don’t want to ‘navigate’ anything. I just want my pills. And if I have to pay $400 for a month’s supply, then my insurance is garbage. End of story.

Lmao tier 1 is just the drugs they don’t even bother to fight over. Tier 3 is where the real money is-big pharma’s golden child. And don’t even get me started on ‘non-preferred generics’-same pill, different bottle, different price. It’s like buying a Coke and being charged $3 because the label has a different font.

Also, ‘formulary exception’? That’s just a polite way of saying ‘you’re gonna wait 6 weeks and still get denied.’

My dad’s on a Tier 5 drug. Pays $4,200 a month. Insurance says ‘we’ll cover 50%.’ So he’s paying $2,100. He’s 72. Works part-time at Walmart. I’m just… wow.

Also, why do we act like this is normal?

It’s funny how we call this a system when it’s really just a series of arbitrary decisions made by people who’ve never had to choose between insulin and groceries

Maybe the real tier isn’t 1 through 5 but rich and poor

And the formulary just pretends to be neutral

From a pharmacy benefits management perspective, tiering is fundamentally a utilization management tool designed to optimize cost-effectiveness while maintaining therapeutic equivalence. The challenge lies in the misalignment between clinical outcomes and economic incentives-particularly when PBMs prioritize rebate capture over patient access.

Value-based tiering represents a promising paradigm shift, but its scalability is limited by data interoperability and formulary governance fragmentation across payers. Until we standardize outcome-based formulary criteria, patients will continue to bear the burden of administrative complexity. Consider advocating for tier reclassification through clinical documentation and prior authorization appeals with structured evidence.