When you pick up a prescription, you might not think about how the drug got to the shelf. But behind every generic pill is a complex battle between companies, patents, and pricing - and it directly affects how much you pay. Two types of generics dominate the market: authorized generics and first-to-file generics. They look the same, work the same, but their impact on price is very different.

What Exactly Is an Authorized Generic?

An authorized generic isn’t some knockoff. It’s the exact same drug as the brand-name version, made by the original manufacturer, just sold without the brand name. Think of it like a company selling the same soda under two labels: one with the flashy logo, one with a plain white bottle. The formula doesn’t change. The factory doesn’t change. Only the box does. These are launched by the brand-name company itself - often as part of a deal with a generic manufacturer. The brand keeps control over production, so quality stays identical. That’s why pharmacies and insurers trust them. They’re not a cheaper copy. They’re the real thing, repackaged.What Is a First-to-File Generic?

Now, the first-to-file generic is a different beast. This is the first generic company to submit an application to the FDA to copy a brand drug. Under the Hatch-Waxman Act of 1984, that company gets 180 days of exclusive rights to sell the generic version. No one else can legally sell the same generic during that time. That exclusivity is valuable. Really valuable. Some first-filers make hundreds of millions in those six months. They’re the only game in town. And because they have no competition, they can set prices higher than they would if others were selling the same thing.Price Difference: The Numbers Don’t Lie

Here’s where it gets interesting. When only the first-to-file generic is on the market, prices drop - but not as much as you’d hope. According to the Federal Trade Commission (FTC), retail prices for generics in this scenario are about 14% below the brand-name price. Pharmacy acquisition costs? About 20% lower. Now, throw in an authorized generic. Suddenly, two versions of the same drug are competing. And prices plunge. In markets with both types, retail prices drop to 18% below brand. Acquisition costs? They fall to 27% below brand. That’s a 7-point jump in savings just from adding one more player. The FTC found that when an authorized generic enters during the 180-day window, retail prices drop another 4-8%. Wholesale prices? They drop 7-14%. That’s not a small bump. That’s real money for patients and insurers. Take a common drug like Lipitor. Without competition, the first generic might sell for 60% off the brand. Add an authorized generic? That discount jumps to 70% or more. That’s hundreds of dollars saved per year per patient.

Why Do Authorized Generics Lower Prices So Much?

It’s simple math: more competition = lower prices. But here’s the twist - authorized generics aren’t just any competitor. They’re the original brand’s own product. That means they’re priced aggressively to undercut the first-filer. Why? Because the brand company wants to capture some of the generic market while still protecting its profits. The first-filer, facing a product that’s identical and often cheaper, has to slash prices to stay relevant. And because the authorized generic has no R&D costs to recoup, it can afford to sell at rock-bottom prices. This forces the first-filer to lower prices too - or lose market share entirely. Pharmacies benefit too. Gross profit per prescription jumps when the first generic arrives. But when an authorized generic joins the mix? Profits rise even more. That’s because they’re buying both versions at deep discounts and selling them at the same retail price. More margin, same shelf space.What About Long-Term Effects?

Some worry that authorized generics hurt innovation. If brand companies can just launch their own generics, why would any generic company bother challenging patents? After all, patent battles are expensive. The risk is that fewer companies will take the plunge, slowing down future generic entry. But the data says otherwise. The FTC studied this for years. Their 2013 report found no measurable drop in the number of patent challenges by generic companies, even after authorized generics became common. The 180-day exclusivity period is still worth hundreds of millions to the first-filer. That’s enough incentive to keep filing ANDAs. Even more telling: authorized generics don’t stay expensive. The FTC found no evidence they’re less aggressive than other generics. Once the exclusivity window closes and more companies enter, prices drop to 95% below brand levels. That’s the real win for consumers.How Do Authorized Generics Affect the Brand Company?

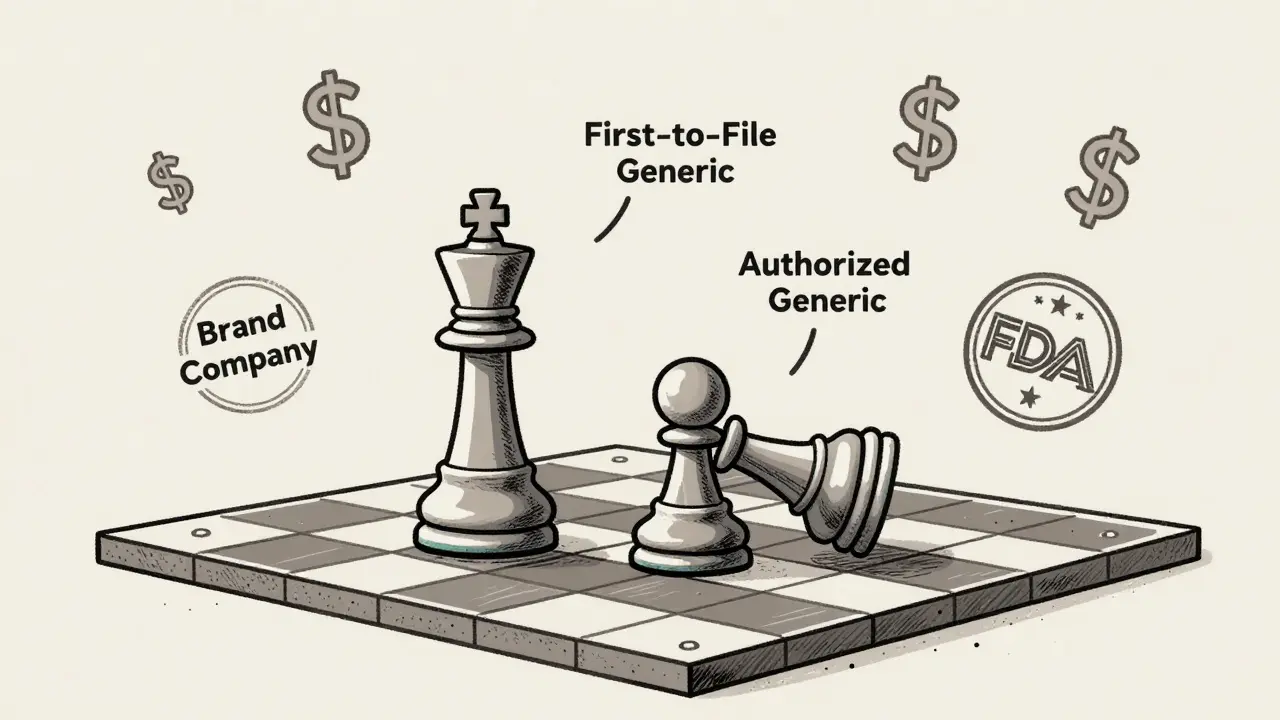

The brand company doesn’t lose money when it launches an authorized generic. In fact, it often gains. By entering the generic market itself, it keeps revenue flowing from a drug that’s about to lose patent protection. It avoids a total revenue cliff. And it can control the timing - sometimes launching the authorized generic right as the first-filer enters, to crush their pricing power. This strategy is so common, it’s now part of patent settlement deals. A brand company might agree to delay its own generic launch in exchange for cash from the first-filer. Or, it might launch the authorized generic immediately to force the first-filer to cut prices early. It’s a chess game - and the brand often has the upper hand.

What About the FDA and Regulations?

The FDA’s Generic Drug User Fee Amendments (GDUFA), updated in 2022, have sped up approvals. First-cycle approval rates jumped from 20% to 66%. That means generic companies get to market faster - in about 13 months less time than before. That’s a big deal. It reduces their costs by $3.5 million on average per application. Faster approvals mean more generics enter the market sooner. That puts pressure on both first-filers and authorized generics. But authorized generics still hold an edge: they’re already approved under the brand’s NDA. They don’t need to go through the full ANDA process. That gives them a head start.Who Wins? Who Loses?

Patients win. Insurers win. Pharmacies win. The only ones who lose are the first-filer generic companies - and even they still make a fortune during their 180-day window. But their profits are cut in half when an authorized generic shows up. The brand company doesn’t lose either. They shift from selling a high-priced branded drug to selling a low-priced generic version - still making money, just with less markup. And they avoid the chaos of a free-for-all generic market. The system isn’t perfect. Some authorized generics disappear after a few years. The FTC found that 20% of them had no sales in Medicare data after five years. But that’s not because they’re bad - it’s because the market got flooded with other generics. Once you have six or more competitors, prices drop so low that even authorized generics can’t sustain profit margins.Bottom Line: Choose Based on Price, Not Brand

When you’re handed a generic prescription, don’t assume one is better than the other. They’re the same drug. The only difference is price - and that’s driven by who’s selling it. If you see two generics on the shelf - one labeled with a generic company name, another with no name at all - ask your pharmacist which is cheaper. Often, the authorized generic is the best deal. It’s the brand’s own product, priced to compete. And it’s the reason you’re paying less than you were five years ago. The bottom line? Authorized generics aren’t a loophole. They’re a market force. And for patients, that’s a good thing.Are authorized generics the same as brand-name drugs?

Yes. Authorized generics are identical to the brand-name drug in active ingredients, dosage, strength, and performance. They’re made in the same factory, using the same formula. The only difference is the packaging and labeling - no brand name.

Why are authorized generics cheaper than the brand?

They don’t carry the marketing, advertising, or R&D costs of the brand. The manufacturer doesn’t need to recoup billions spent on drug development. They sell it at cost-plus, which means much lower prices - often 20-30% below the brand.

Do authorized generics reduce innovation in generics?

No. The FTC has found no evidence that authorized generics reduce the number of patent challenges by generic companies. The 180-day exclusivity period still offers huge financial rewards, so companies continue filing ANDAs even when authorized generics are common.

Can I ask my pharmacist for an authorized generic?

Absolutely. Ask if the pharmacy carries the authorized generic version of your prescription. It’s often cheaper than the first-to-file generic and just as safe. Many insurers even prefer it because it lowers their costs.

Why does the brand company sell an authorized generic?

To protect its revenue. Once a drug loses patent protection, sales drop fast. By launching its own generic, the brand company keeps a share of the market - and often uses it to undercut the first-filer’s pricing, ensuring the generic market doesn’t spiral into chaos.

12 Comments

I never realized how much the packaging affects what I pay. I always thought generics were just cheaper versions, but finding out the authorized ones are literally the same pill in a plain box? Mind blown. I’ve been overpaying for years.

Now I ask my pharmacist every time. They usually give me the no-name one without me even asking anymore. Saved me like $80 on my blood pressure med last month.

Why do we even have brand names on pills? It’s like buying the same cereal in a red box vs. a white one and paying extra for the red.

Someone should make a browser extension that auto-replaces brand names with ‘authorized generic’ when you search for prescriptions. That’d be revolutionary.

Very informative. The economic structure behind generic drug pricing is far more complex than most realize. In India, we see this differently-many generics are produced without any brand association at all, and pricing is dictated by government regulation rather than market competition.

Still, the principle remains: more players = lower prices. The US system, while innovative, is unnecessarily convoluted. The 180-day exclusivity window feels like a loophole dressed as policy.

so like... the brand company just makes the same thing and sells it cheaper to ruin the first generic's profit

that's kinda wild

you know what this reminds me of? when apple started selling their own airpods in different colors and called them 'premium' but they were the same inside

its not about the product its about who owns the brand and how much they can charge for the label

and honestly i think the fda should just make all generics have the same packaging so no one gets confused

or maybe the brand companies should just stop making authorized generics because its like cheating the system

This is one of those things that sounds like corporate trickery but actually helps people. I used to think authorized generics were some kind of scam, but now I get it-they’re the brand’s way of saying ‘we’re not going to fight this, we’ll just beat you at your own game.’

It’s not evil. It’s just capitalism doing its weird, messy thing.

And honestly? More of this. Let the market work. Patients win. Pharmacies win. Even the first-filers still make bank during their window.

Why are we still arguing about this? Just give people the cheapest version and move on.

Oh wow. So the American healthcare system is just a game of corporate poker where the brand companies hold all the cards and the FDA is the guy who keeps dealing them new ones?

And we’re supposed to be grateful because sometimes, just sometimes, they let us win a few bucks?

Brilliant. Just brilliant. Tell me again why we don’t just nationalize drug manufacturing? I’m sure it’s because ‘innovation’.

authorized generics are the unsung heroes of prescription savings and i’m so tired of people calling them ‘scams’ or ‘loopholes’

they’re not. they’re the only reason my insulin costs $30 instead of $300

and yes i know the brand company is still making money but guess what? they’re not making $2000 per script anymore and that’s what matters

also i just asked my pharmacist for the ‘no name’ one and she gave me a free sample of the authorized generic because she said ‘you’re clearly smart enough to ask’

thank you to whoever wrote this post. you just saved me a hundred dollars this month.

Let’s be clear: this entire system is a rigged casino. The FTC’s data is cherry-picked. Authorized generics are not ‘market forces’-they’re anticompetitive collusion disguised as consumer benefit.

When the brand manufacturer enters the generic market, it eliminates the incentive for true innovation. Why would a small generic company invest millions to challenge a patent if the brand can just drop its own version the moment they file?

This isn’t capitalism. It’s monopolistic theater. And the patients? They’re the suckers who think they’re getting a deal when they’re just being fed crumbs from the same table.

STOP TALKING ABOUT THE DATA AND START TALKING ABOUT THE PEOPLE.

I have a friend with type 1 diabetes who skips doses because the first-to-file generic was $120 and she’s on SSDI.

Then the authorized generic came in at $45.

She didn’t care who made it. She just cried because she could breathe again.

So don’t give me your corporate chess games. This isn’t about patents. It’s about whether someone gets to live another day.

Authorized generics = lifesavers. Fight me.

Wait wait wait-I just realized something. What if the brand companies are secretly working with the first-filers? Like, what if the first-filer is actually owned by the same parent company? I looked up the corporate structure of one of those ‘generic’ companies and guess what? Same parent as the brand.

And the FDA? They’re in on it. I found a whistleblower report from 2018-hidden in plain sight.

This isn’t competition. It’s a coordinated price-fixing scheme. The authorized generic? It’s not lowering prices-it’s creating the illusion of competition so the public doesn’t riot.

They’re selling us the same pill, under two fake labels, and calling it ‘market dynamics.’

Wake up people. This is how they control us.

There is no such thing as an ‘authorized generic.’ That term is a marketing ploy designed to confuse consumers into believing they are receiving a superior product when, in fact, all generics are required by law to be bioequivalent. The distinction is meaningless.

Furthermore, the FTC’s findings are statistically insignificant and based on cherry-picked datasets. The real issue is not pricing-it’s the lack of transparency in pharmacy benefit manager (PBM) rebates, which inflate retail prices regardless of which generic is dispensed.

Stop romanticizing corporate strategy. The problem isn’t the authorized generic. The problem is the entire pharmaceutical supply chain is a fraud.

Authorized generics are a necessary mechanism to prevent monopolistic pricing by first-filers. The 180-day exclusivity period was intended to incentivize patent challenges. It has been weaponized. The brand’s entry into the generic market restores competitive equilibrium. The FDA’s GDUFA reforms have accelerated this process. Market forces are working as intended.

Any suggestion of collusion is unsupported by empirical evidence. The data shows consistent price reductions and increased access. The system is imperfect but functional.

Resistance to authorized generics is ideological not economic.

End.