When two companies clash over a patent, it’s not always about who’s right-it’s about who can afford to wait. Most patent disputes never go to trial. In fact, 85.7% of them settle before a judge ever hears the case. Why? Because litigation is expensive, risky, and slow. A single patent lawsuit can cost $3 million to $5 million just to get to trial. For many companies, especially smaller ones, that’s more than they make in a year. So they negotiate. And how they negotiate shapes entire industries.

Why Companies Settle Instead of Fighting

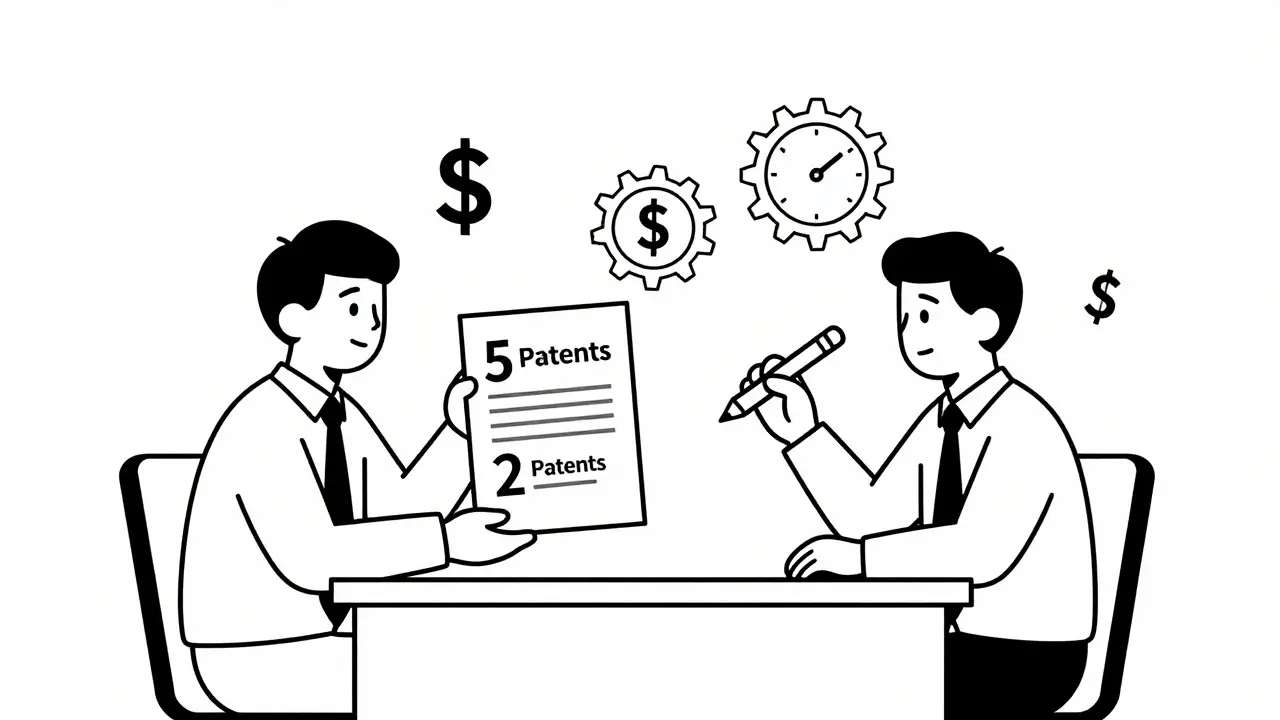

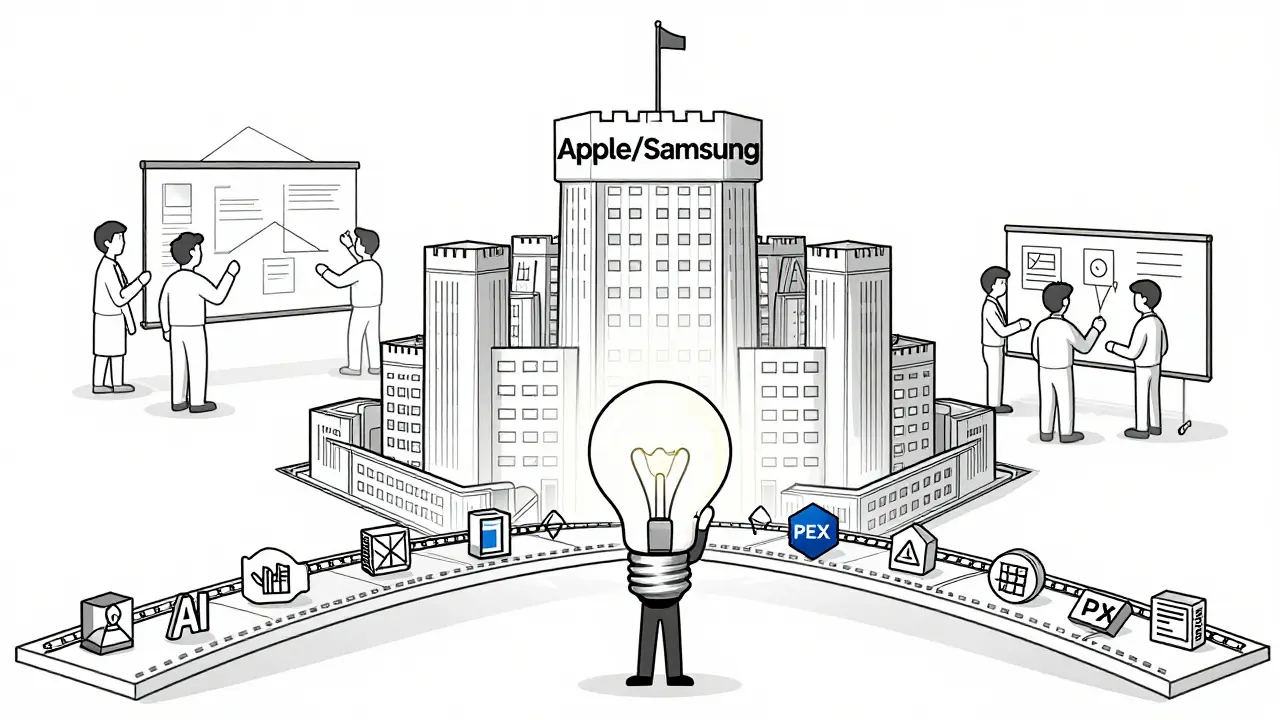

Patents are legal weapons, but they’re also business tools. When a company sues another for patent infringement, it’s rarely just about stopping a product. It’s about control, money, and market position. Take the Apple vs. Samsung case. At its peak, they were fighting over 10 patents. By the time they settled, they’d cut it down to 5. Why? Because each patent added months of legal work, expert testimony, and court delays. Reducing the number of claims made settlement possible. Most settlements happen between the Markman hearing-where judges define what the patent claims actually mean-and summary judgment. That’s the sweet spot. Both sides have spent months building their cases. They know what’s strong, what’s weak. They’ve seen the evidence. That’s when rational decisions get made. The average settlement value? It depends on who’s involved. If it’s a patent troll (a non-practicing entity), the median payout is around $1.2 million. But if it’s two big competitors, like Qualcomm and Apple, the number jumps to $8.7 million. That’s because the stakes aren’t just about royalties-they’re about who gets to license tech to others, who controls future innovation, and who can block a rival’s product.The Anatomy of a Patent Settlement

Successful negotiations don’t happen by accident. They follow a clear structure. Here’s what goes into it:- Patent portfolio assessment: Companies don’t negotiate every patent they own. They pick 3 to 15 key ones-usually the ones that cover core features of a product. If you’re suing over a smartphone, you focus on the touch interface, camera software, or battery management patents, not the packaging design.

- Claim chart preparation: This is a detailed map showing exactly how the accused product uses the patented technology. It’s not enough to say, “They copied us.” You have to prove it, line by line.

- Validity analysis: Before you demand money, you need to know if your patent can actually hold up. A 2021 USPTO study found that nearly 4 out of 10 patents asserted in court were later invalidated. If your patent is weak, you’re in trouble.

- Freedom-to-operate analysis: This isn’t just about defending your own patents. It’s about checking whether you’re infringing someone else’s. Many companies settle because they realize they’re also violating someone else’s IP.

These steps aren’t optional. Skipping one can cost you millions. Companies like Intel and Ericsson spend $150,000 to $300,000 just on pre-settlement validity reviews. It’s an investment-not an expense.

How Settlements Actually Work

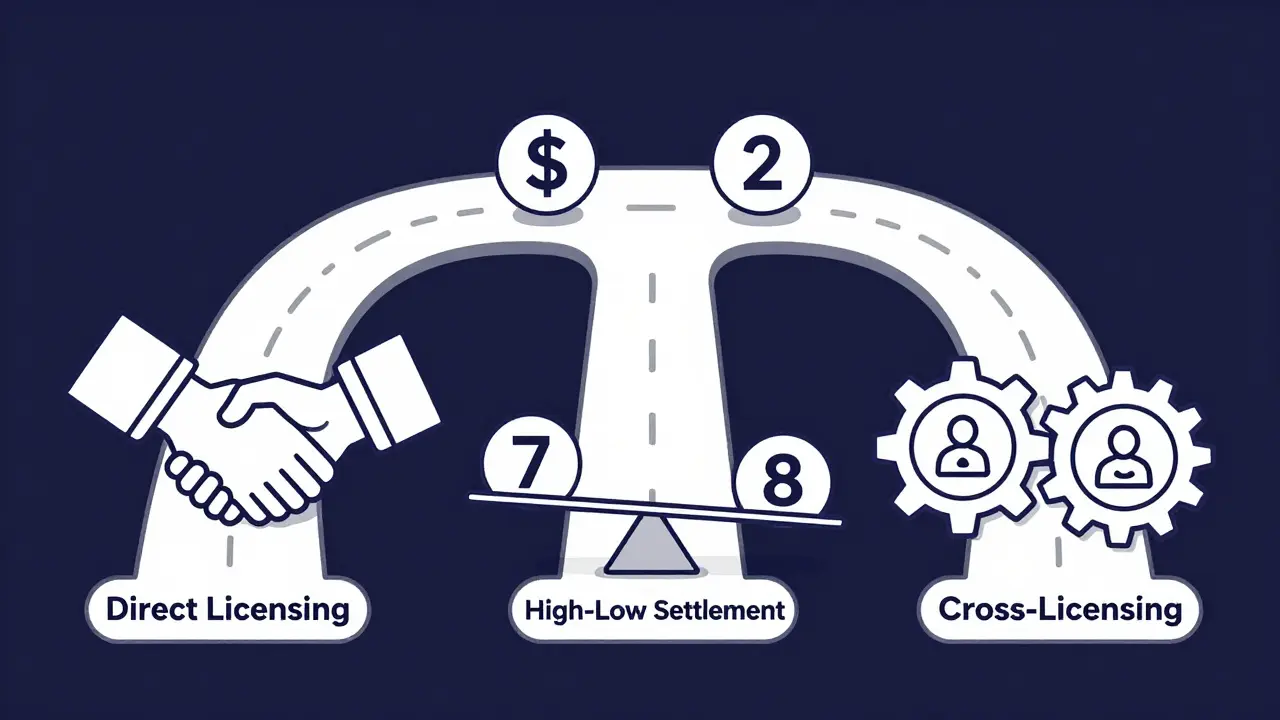

There are three main ways companies settle patent fights:1. Direct Licensing

The classic model: one company pays the other a lump sum or ongoing royalties-usually 1.5% to 5% of product sales. This works best when both companies make similar products. For example, if you make smartphones and I make chips for smartphones, we can agree to cross-license. It’s clean. Simple. But it requires trust. Only about 52% of these deals close without drama.2. High-Low Settlements

This one’s clever. Both sides agree on two numbers: a minimum payment if the court rules in their favor, and a maximum if it rules against them. It’s like betting on a game-you both agree on the score range before the whistle blows. This method works in 78% of cases between competitors who have real business relationships. But it fails almost every time with patent trolls. Why? Because trolls don’t care about long-term deals. They want cash now.3. Cross-Licensing

This is the big leagues. Two companies swap access to their entire patent portfolios. No money changes hands. Instead, they agree: “You let us use your 5G patents, we’ll let you use our AI chip patents.” This is common in telecom, semiconductors, and software. In fact, 73% of disputes between major tech firms end this way. The trick? Valuing each side’s patents fairly. One company might have 500 patents, but only 20 are truly valuable. The other might have 100, but 30 are essential. That’s where experts come in-using royalty stacking models to avoid overpaying.

What Really Drives the Negotiation

It’s not just about the patents. It’s about the people behind them. Robert Armitage, former general counsel at Intel, said it best: “In the semiconductor industry, we’ve found that joint R&D after a settlement creates more value than licensing alone.” After settling with MEDIATEK in 2018, Intel didn’t just pay a fee. They partnered to co-develop 5G tech. That deal saved them over $200 million in research costs. That’s the hidden win: turning a fight into a collaboration. But there’s a dark side. Professor Saurabh Vishnubhakat from Texas A&M found that high-low settlements can backfire. They encourage companies to file weak patents just to get leverage. His research shows this increases overall litigation costs by 12-15%. It’s like playing chicken with the legal system. Another overlooked tactic? Strategic concessions. In 61% of successful settlements, one side gives up something small to get something big in return. Maybe they agree to a lower royalty rate if the other side extends the license term. Or they drop a lawsuit in exchange for access to a complementary technology. It’s not about winning. It’s about trading.The New Tools Changing the Game

Patent negotiation isn’t stuck in the past. New tools are reshaping how deals are made. The USPTO’s Patent Evaluation Express (PEX) program, launched in 2023, lets companies get a non-binding opinion on patent validity in weeks-not years. It costs 60% less than traditional reviews. Already, 17% of new settlements use it to avoid long battles. AI is another game-changer. Tools like PatentSight’s AI analyzer can scan thousands of patents and prior art in days instead of weeks. But here’s the catch: AI still misses 18.7% of key references, according to a 2023 study in Nature Machine Intelligence. Humans still need to double-check. And then there’s blockchain. IBM and Microsoft are testing smart contracts that automatically pay royalties based on real-time sales data. Imagine a phone sells 10,000 units in a week-payment is triggered instantly. This could cut post-settlement disputes by 35-40%. No more arguing over sales reports. No more delays.

Where the System Is Breaking Down

Not all trends are good. As technology gets more complex, so do patent fights. A single AI-powered medical device might rely on 500 different patents from 20 different companies. That’s a patent thicket. And thickets make settlement nearly impossible. According to WIPO’s 2022 index, negotiating in these fields is 300% harder than in traditional industries. The Unified Patent Court in Europe, which started in June 2023, has made things faster-but also more unpredictable. Cross-border settlements in Europe jumped 22% in the first six months. Companies are rushing to settle before the court sets new precedents. And then there’s the FRAND problem. When a patent is part of a technical standard-like 4G or Wi-Fi-it must be licensed fairly. But what’s “fair”? The European Commission fined Qualcomm €242 million in 2018 for refusing to license SEPs on fair terms. Companies are now terrified of being accused of anti-competitive behavior. That’s forcing more openness-but also more legal risk.Who Wins? Who Loses?

Big companies win. They have teams of lawyers, economists, and engineers dedicated to patent strategy. Fortune 500 firms settle 89% of their disputes before trial. Small companies? Only 63%. Why? Because they can’t afford the cost of discovery, expert witnesses, or court fees. The real winners aren’t the ones who win in court. They’re the ones who walk away with a license, a partnership, or a new R&D deal. The losers are the ones who think a patent is a shield. It’s not. It’s a sword-and if you swing it without strategy, you’ll cut your own hand off.What You Need to Know

If you’re a company facing a patent threat:- Don’t panic. Most cases settle.

- Know your bottom line. Calculate how much litigation will cost versus what you’d pay to settle.

- Don’t rely on your legal team alone. Bring in technical experts. They’ll spot weaknesses you didn’t know existed.

- Look for trade-offs. What can you give up to get something better? Access to tech? Extended rights? Joint development?

- Use new tools. PEX, AI analysis, and blockchain-based tracking aren’t futuristic-they’re here, and they’re cheaper than ever.

If you’re the one being sued, remember: the goal isn’t to win. It’s to survive-and maybe even thrive after.

What happens if a patent settlement fails?

If settlement talks break down, the case moves toward trial. But even then, many cases settle during trial-sometimes on the courthouse steps. Going to trial is expensive and unpredictable. A jury doesn’t understand patents. A judge might invalidate key claims. Companies usually only go to trial if they believe they have a near-certain win or if they’re trying to set a legal precedent.

Can a small company negotiate with a giant like Apple or Samsung?

Yes, but only if they have strong, well-documented patents. Small companies that win settlements often hold essential patents in high-demand areas-like camera sensors, battery efficiency, or voice recognition. They don’t need a huge portfolio. They need one patent that’s critical to a product. The key is proving that the patent is valid and that the big company’s product literally depends on it.

Are patent settlements public record?

Most are. Settlement agreements are filed with the court and become public, though some details-like exact royalty rates-can be redacted. Companies often agree to confidentiality clauses, but the fact that a settlement occurred is always public. That’s why investors and competitors track settlement filings closely.

How long do patent settlement negotiations usually take?

On average, 6 to 9 months. But it varies. Simple cases with clear patents can settle in 2-3 months. Complex cases involving multiple jurisdictions or hundreds of patents can take over a year. The timeline often depends on how fast both sides can complete validity analyses and claim chart reviews. Companies that prepare early move faster.

What’s the difference between a patent license and a settlement?

A settlement ends a legal dispute. A license is an agreement that allows one party to use another’s patent. Settlements often include licensing terms, but not all licenses come from settlements. Some licenses are negotiated proactively-before any lawsuit is filed. That’s called a “clearance license.” Settlements are reactive. They happen after a conflict arises.

Do patent settlements affect innovation?

It depends. If settlements lead to cross-licensing and joint R&D, they boost innovation. But if they’re used to block competitors with weak patents, they stifle it. The biggest danger is when companies use patents as weapons instead of tools. That’s why regulators watch closely-especially in industries like telecom and pharmaceuticals where standards matter.